IBM Is Not a Perfect Dividend Stock. But It’s Close and Here’s Why.

I’m not an income investor so I don’t invest purely for dividends.

However, if I were to aim for dividend stocks, here’s how I would analyze it.

What You’ll Learn

- A checklist for a set of desired characteristics for dividend stocks.

- How to check consistency and predictability with the financial statements.

- Important quality factors to look for in a dividend stock.

Given the low interest rates and the dangers associated with bonds in such an environment, dividend stocks are attractive for a huge number of investors.

An area that is growing with dividends is the tech space.

It’s funny to think that we now invest in a market that can combine both dividend investing with tech stocks. But as many giant tech stocks are flush with cash, it’s not surprising to see these companies finally open their wallet to pay investors.

(I’m looking at you Apple)

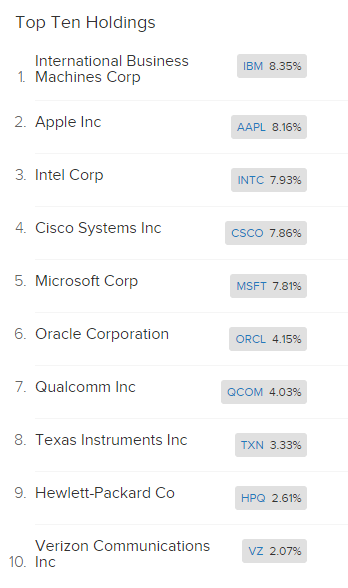

To make things even easier, there are all sorts of ETF’s out there, including this Tech Dividend ETF.

But my method of choice is to look at individual stocks in the ETF to see if anything gets my interest.

As for this ETF example, here are the top 10 holdings.

So let’s take a look at the number one stock on the list, International Business Machine.

Desired Characteristics of Dividend Stocks

When I look at dividend stocks, I look for the following characteristics.

- Strong franchise

- Consistent and predictable

- Strong balance sheet so that dividends can easily be paid

- Dividend payout

- Dividend growth

What is a Strong Franchise?

The word “franchise” is used to define a company with a strong brand, a good business model and that generates returns that exceeds its cost of capital.

Since I’m looking for a company that can continue to pay shareholders, the business must have a moat. I’m not looking for a high-flying growth tech stock that makes billions one year and then loses it the next.

I obviously want one that is well run, and although growth and competitive pressures exist, the business generates cash day in and day out.

A pet peeve of mine is where a company will take on debt to pay dividends. That’s just a sign of a weak franchise and poor management team.

Easy Way to Determine a Strong Franchise Using EPV

A quick check to see whether the company has a strong franchise is to compare the EPV (Earnings Power Value) with the book value or net reproduction value.

This is a concept from the Earnings Power Value model created by professor Bruce Greenwald of New York University.

Rather than get into the full details, the short version of it is that if EPV is greater than the net reproduction value, the company has a moat.

Net reproduction value is the money it will take for anyone to “reproduce” the same business from scratch.

A company where EPV is equal to its net reproduction value or less than the net reproduction value is a company with no moat and one that destroys value and cannot sustain its business in the face of competition.

Here’s a screen grab from the Old School Value stock valuation model detailing this information.

The graph below is the type of graph that I want to see for a strong franchise business.

Even from a quantitative view, IBM clearly has a moat. It may have eroded with increased competition in the IT space, but the company isn’t going anywhere.

So let’s give it a star for being a good boy.

- IBM gets a star for strong franchise (1 star)

Importance of Predictability and Consistency

When looking at dividend stocks, I look to buy companies that have consistent and predictable margins. This is also true for the balance sheet and cash flow statement.

A company with a consistent balance sheet will ensure that financial risk of collapse does not occur. Likewise for the cash flow statement, steady growth in cash from operations and free cash flow or owner earnings are all good signs to look out for.

There are a few ways to check for consistency and predictability but here’s my easy way.

How to Check Consistency and Predictability

One way that I check for earnings consistency is by looking at the following four pieces of data in the image below.

It’s the Absolute PE model that I also use to check business, financial and earnings quality.

Look at how gross margin, net margin, earnings and cash from operations have been trending.

For IBM, net margins, earnings and cash from operations have been inconsistent and going down the past 5 years.

This points to how sustainable the dividend will be. After all, I want stocks that will increase their dividend, instead of just keeping it steady for years on end.

- IBM gets zero stars for consistency over the past five years (0 stars)

Check for a Strong Balance Sheet so that Dividends Can Easily Be Paid

Before you dive into the meat of the content, if you haven’t signed up with your email for our free investment resources, do so.

I’ll immediately send you extra stock ratios notes, checklists, spreadsheets and additional downloads you can succeed with.

Checking the balance sheet will let you know how healthy a company is.

What I don’t want is a company that is heavily loaded with debt and paying dividends. There are some companies where they continue to pay dividends by issuing debt, just to prevent disappointing investors and causing the stock price to fall.

It’s easy to recognize with a quick glance of the balance sheet ratios over several years.

This will give you a very good picture of the company debt structure.

You can see IBM taking on debt based on the increase in the debt to equity ratio.

At the moment, long term debt makes up 30% of the total liabilities and equity. The current situation has not been damaged so IBM is safe in this regard.

- IBM gets a star for its strong balance sheet (1 star)

Calculating Dividend Payout

The dividend payout ratio is different to dividend yield in that it looks to see how well earnings support the dividend payment. If the ratio is low, it means that the dividend is easily covered by earnings and the company will not issue debt to pay dividends.

A point to note is that mature companies tend to have a higher payout ratio because it will distribute more of its cash, while growing or smaller companies will have a small payout ratio because it will use the cash to fuel further growth.

The formula for the Dividend Payout Ratio is

Dividend Payout Ratio= Dividend / Net Income

The dividend payout ratio can also be adjusted to use free cash flow instead of net income.

Dividend Payout Ratio= Dividend / Free Cash Flow

The payout ratio can be easily calculated by going to the EPS section of the income statement where EPS and dividends per share are located.

Here is a look at the FCF numbers that show how easily dividends can be covered by cash not needed to run the business.

- IBM gets a star for its strong dividend payout (1 star)

Check Historical Dividend Growth and Future Growth Possibilities

I’ve left the most obvious part for last.

Dividend growth.

To continually generate income from your portfolio, you need to find companies that will increase their dividend each year. There are many companies that issue a high yielding dividend, but then the problem becomes the dividend staying at the same level despite growth in earnings and cash.

In order to determine whether a company will continue to increase the dividend, you look to see what the growth is for net income and free cash flow.

The thing with IBM is that despite year on year deterioration of EPS and FCF, IBM increased its dividend to 1.09$ and increased its dividend payout ratio to 19.78%.

Also, the dividend has grown for 15 years and that’s quite an accomplishment in itself.

With an expected 5 year EPS growth of around 9%, IBM is also initiating plans to return more money to shareholders. You can expect the dividend growth to continue.

The business may not have the growth it once had, but IBM is determined to return cash to shareholders through dividends and buybacks.

- IBM gets a star for its dividend growth (1 star)

IBM is a 4 (out of 5) Star Dividend Stock

As you can see, there’s nothing fancy to how I analyze dividend stocks.

The beauty of dividend stocks is the focus on predictability and consistency. So that reduces the universe of stocks to very stable, cash flow positive companies, making it easy to analyze.

Trying to hit a homerun isn’t the key as dividend investing is a marathon and not a sprint.

This is how I’d analyze a dividend stock.