Value Creation Checklist: Measuring the Moat

What You’ll Learn

- Checklist to measure a moat

The most important thing to me is figuring out how big a moat there is around the business. What I love, of course, is a big castle and a big moat with piranhas and crocodiles. ―Warren Buffett

Measuring the Moat: Assessing the Magnitude and Sustainability of Value Creation

Below is an excerpt of “a complete checklist of questions to guide the strategic analysis” published in the paper Measuring the Moat: Assessing the Magnitude and Sustainability of Value Creation, written by Michael J. Mauboussin and Dan Callahan.

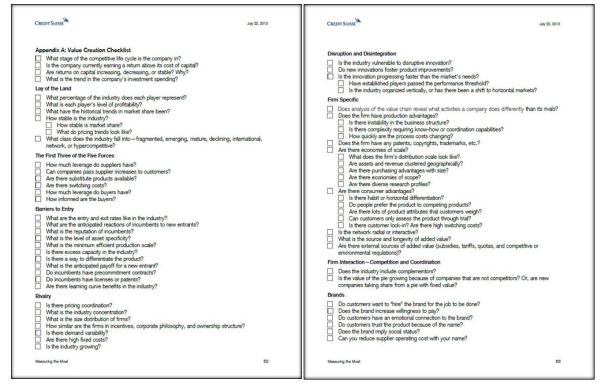

Value Creation Checklist

Value Creation Checklist

- What stage of the competitive life cycle is the company in?

- Is the company currently earning a return above its cost of capital?

- Are returns on capital increasing, decreasing, or stable? Why?

- What is the trend in the company’s investment spending?

Lay of the Land

Lay of the Land

- What percentage of the industry does each player represent?

- What is each player’s level of profitability?

- What have the historical trends in market share been?

- How stable is the industry?

- How stable is market share?

- What do pricing trends look like?

- What class does the industry fall into—fragmented, emerging, mature, declining, international, network, or hypercompetitive?

The First Three of the Five Forces

The First Three of the Five Forces

- How much leverage do suppliers have?

- Can companies pass supplier increases to customers?

- Are there substitute products available?

- Are there switching costs?

- How much leverage do buyers have?

- How informed are the buyers?

Barriers to Entry

Barriers to Entry

- What are the entry and exit rates like in the industry?

- What are the anticipated reactions of incumbents to new entrants?

- What is the reputation of incumbents?

- What is the level of asset specificity?

- What is the minimum efficient production scale?

- Is there excess capacity in the industry?

- Is there a way to differentiate the product?

- What is the anticipated payoff for a new entrant?

- Do incumbents have precommitment contracts?

- Do incumbents have licenses or patents?

- Are there learning curve benefits in the industry?

Rivalry

Rivalry

- Is there pricing coordination?

- What is the industry concentration?

- What is the size distribution of firms?

- How similar are the firms in incentives, corporate philosophy, and ownership structure?

- Is there demand variability?

- Are there high fixed costs?

- Is the industry growing?

Disruption and Disintegration

Disruption and Disintegration

- Is the industry vulnerable to disruptive innovation?

- Do new innovations foster product improvements?

- Is the innovation progressing faster than the market’s needs?

- Have established players passed the performance threshold?

- Is the industry organized vertically, or has there been a shift to horizontal markets?

Firm Specific

Firm Specific

- Does analysis of the value chain reveal what activities a company does differently than its its rivals?

- Does the firm have production advantages?

- Is there instability in the business structure?

- Is there complexity requiring know-how or coordination capabilities?

- How quickly are the process costs changing?

- Does the firm have any patents, copyrights, trademarks, etc.?

- Are there economies of scale?

- What does the firm’s distribution scale look like?

- Are assets and revenue clustered geographically?

- Are there purchasing advantages with size?

- Are there economies of scope?

- Are there diverse research profiles?

- Are there consumer advantages?

- Is there habit or horizontal differentiation?

- Do people prefer the product to competing products?

- Are there lots of product attributes that customers weigh?

- Can customers only assess the product through trial?

- Is there customer lock-in? Are there high switching costs?

- Is the network radial or interactive?

- What is the source and longevity of added value?

- Are there external sources of added value (subsidies, tariffs, quotas, and competitive or environmental regulations)?

Firm Interaction—Competition and Coordination

Firm Interaction—Competition and Coordination

- Does the industry include complementors?

- Is the value of the pie growing because of companies that are not competitors? Or, are new companies taking share from a pie with fixed value?

Brands

Brands

- Do customers want to “hire” the brand for the job to be done?

- Does the brand increase willingness to pay?

- Do customers have an emotional connection to the brand?

- Do customers trust the product because of the name?

- Does the brand imply social status?

- Can you reduce supplier operating cost with your name?

About the Author

The pseudonymous Hurricane Capital was Born in the 80’s, lives in Sweden with a Masters of Science in Business and Economics from Stockholm University. Got interested in value investing and devotes his free time and investing. The main goal through the Hurricane Capital blog is to learn about different investing topics, investors and business cases for investment.

The pseudonymous Hurricane Capital was Born in the 80’s, lives in Sweden with a Masters of Science in Business and Economics from Stockholm University. Got interested in value investing and devotes his free time and investing. The main goal through the Hurricane Capital blog is to learn about different investing topics, investors and business cases for investment.